Latest News

Skin Cancer Awareness Month

June 2, 2025 | submitted by The Nidec Human Resources Team

Protect yourself with a complete approach

As we head into the summer months, fun in the sun calls for increased skin cancer prevention measures. Skin cancer is the most common cancer in the U.S. and can affect anyone, regardless of skin color. It is estimated that one in five Americans will develop skin cancer in their lifetime. Yet many skin cancers can be prevented and when caught early, skin cancer is highly treatable.

Enjoy the longer days of summer and help protect yourself year-round by following these tips:

Practice Safe Sun

- Seek shade – the sun’s rays are the strongest between 10 a.m. and 4 p.m.

- Wear sun-protective clothing – lightweight, full-coverage clothing ideally with ultraviolet protection factor (UPF), wide-brimmed hat and sunglasses with UV protection

- Apply sunscreen – broad-spectrum, water-resistant, SPF of 30 or higher for all skin not covered by clothing and reapply every two hours or after swimming and sweating

Perform Skin Checks

- Examine your skin head-to-toe every month as explained by the American Academy of Dermatology here

- See a dermatologist at least once a year for a professional skin exam

Source: The Skin Cancer Foundation and American Academy of Dermatology Association

Mind your mental health—it matters

May 7, 2025 | submitted by The Nidec Human Resources Team

Resources available to you and your family

At Nidec, we recognize that mental health is important every month of the year. This year, during May – which is Global Employee Health and Fitness Month – take the opportunity to either begin or reinvent your own wellness and mental health journey.

The first step can be the hardest, which is why Nidec makes it easy for you to reach out to the Employee Assistance Program (EAP) for help with personal or work issues.

The EAP is a 24/7 confidential resource for you to get help managing any number of life’s stressors:

- Life: work/life issues, financial stress, legal issues, etc.

- Guidance: health/wellness, relationships, investments, home/auto, etc.

- Well-being: physical challenges, burnout, time management, anxiety, depression, eating disorders, etc.

- Family: family care services, family counseling, childcare, adoption, grief or loss, nutritional guidance, etc.

This month also is a good time to support the wellness and mental health journey of your family members so they can realize their full health potential, too. It could be as effortless as sharing with them how to connect with and use the EAP.

Call H&H Health, our EAP provider, to get help, schedule an appointment, or access other EAP services. Phone lines are open 24/7 at 314.845.8502 or 800.832.8303. Or visit hhhealthassociates.com.

A second step is to participate in the Stride to the Tide wellness challenge. Log 200,000 steps before June 1 to complete the challenge and receive 35 points toward your wellness incentive! Do you use a fitness-tracking device such as Fitbit or Garmin? You can sync your device with your wellness adventure to make tracking easier. Click here for instructions. If you are an Apple user, you will need to log in to your Asset Health Mobile app periodically to ensure your steps are counting toward the challenge.

Your financial wellness

April 11, 2025 | submitted by The Nidec Human Resources Team

Tips to make this month less taxing

April marks the first few weeks of spring, launches spring cleaning, and tax season. There are a few things you can do to add a little spring to your step and make this month less taxing. Your Nidec benefits can help you along the way.

- Reduce your 2026 healthcare premium costs by signing up for Nidec Wellness Challenges this year. Visit Your Wellness>Wellness Program on your benefits website for more information.

- Commit to walking 7,000 steps each day. You’ll get exercise and do great things – inexpensively – to clear your head.

- Check your Nidec 401(k) retirement plan contributions. Is it time to rebalance your account? Are you taking full advantage of the 401(k) plan to help reduce your taxable income? Are you contributing enough to receive the company match? Visit Your Financial Security>Retirement.

- Consider increasing your retirement plan contribution by 1% each June until you reach the plan limit of 10% to help you save more money in the future. Your Financial Security>Retirement.

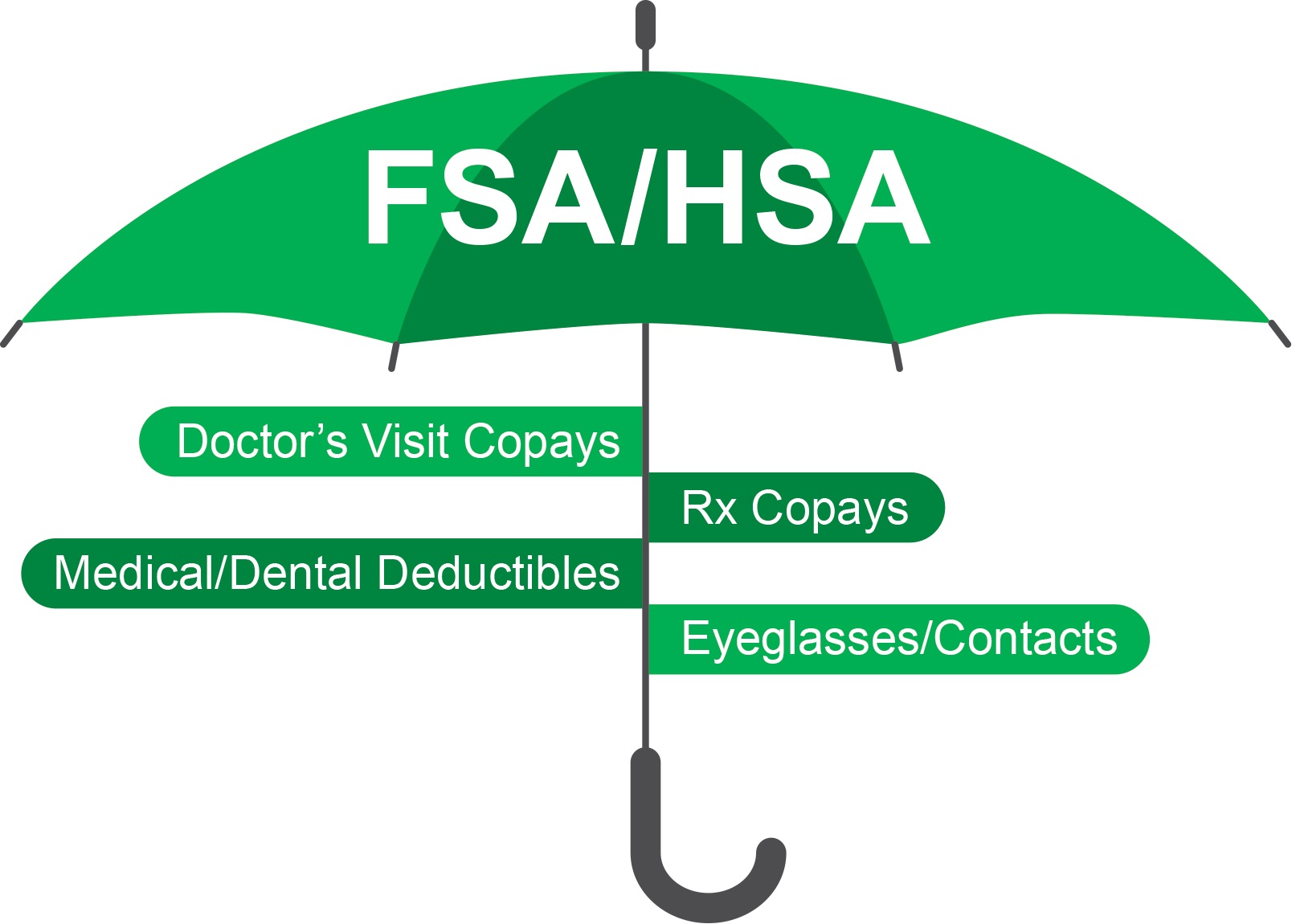

- Review the list of Flexible Spending Account (FSA) eligible items for reimbursement. Visit Your Financial Security>FSA on your benefits website.

Spring forward with health and financial wellness tips

March 14, 2025 | submitted by The Nidec Human Resources Team

Protect your health and your finances by keeping these tips at the forefront this month.

March 15 deadline to use or lose Flexible Spending Account (FSA) funds

If you missed the December 31 FSA deadline, the grace period is your last opportunity to use your tax-free funds to improve your health and make your money go farther. Make use of every FSA dollar by the March 15 deadline. Any remaining funds in an FSA account after the deadline will be forfeited. It’s your money; don’t lose it!

For additional information, including a list of eligible items for reimbursement, go to Your Financial Security>Flexible Spending Account (FSA) on your benefits website.

March is Colorectal Cancer Awareness Month

Colorectal cancer is the second deadliest cancer in the U.S., affecting about one in 24 people. Yet it is also one of the few cancers that is highly preventable with screening and highly treatable when caught early. Take advantage of your medical benefits and add this screening to your preventive care appointments if you’re age 45 or older.

Source: Colorectal Cancer Alliance

Commit to a healthy lifestyle today for a lifetime of heart health

February 18, 2025 | submitted by The Nidec Human Resources Team

With American Heart Month upon us, there’s no better time to share a reminder that Nidec cares about the health of you and your family. Heart disease is the leading cause of death in the United States, affecting all ages, genders, and ethnicities. Take an active role in reducing your risk by continuing or starting some heart-healthy habits!

- Learn about your risk: Know and manage your blood pressure and cholesterol levels

- Eat a healthy and balanced diet: Incorporate more vegetables and fewer processed foods

- Be active and reduce stress: Schedule blocks of time to move more throughout the day

- Maintain a healthy weight: Even a small weight loss can make a difference

- Stay accountable: Ask friends and family to join you to stay motivated

Your Nidec Wellness Program is a valuable resource to support your healthy habits and earn discounted medical plan premiums. Begin by completing your Health Assessment and biometric screening. You must complete these to start earning points. Then complete wellness activities of interest to you.

Start today by checking out the details on requirements, wellness activities, and incentive tiers here or visit Your Wellness>Wellness Program on your employee benefits website.

Source: American Heart Association

Plan ahead with voluntary benefits including AI, CII and HI

October 21, 2024 | submitted by The Nidec Human Resources Team

Nidec offers access to voluntary benefits as part of the Total Rewards package. This month, look at three important voluntary benefits that are worth considering enrolling for during our open enrollment period – which is Nov. 4-Nov. 18, 2024.

- Accident Insurance – Cigna Accident Insurance helps protect you in the event of an injury occurring off the job. This plan is designed to pay cash directly to you, the employee. The additional cash support from this benefit can be used to help pay any out-of-pocket expenses related to the injury. Payments are made tax free and can be used at your direction. Visit Accident Insurance | Nidec Total Rewards for more information.

- Critical Illness Insurance – There can be a lot of expenses associated with a critical illness and a major medical plan may not cover them all. Critical Illness coverage with Cigna pays cash directly to you, the employee, upon a diagnosis of a critical illness. Visit Critical Illness Insurance | Nidec Total Rewards for more information.

- Hospital Indemnity Insurance – Hospital Indemnity Insurance with Cigna is designed to provide financial assistance for an event that results in a hospital confinement, to supplement your current coverage. Employees can use the benefit to meet any out-of-pocket expenses and extra bills that can occur. Benefits are paid directly to you, regardless of the actual cost of treatment. Visit Hospital Indemnity Coverage | Nidec Total Rewards for more information.

As we all prepare for Nidec’s Open Enrollment 2025 period – which is Nov. 4-Nov. 18, 2024 – this is a good time to access whether enrolling for these benefits is a good choice for you and your family in 2025.

Prioritize your financial wellbeing this fall

October 1, 2024 | submitted by The Nidec Human Resources Team

Fall is a great time to check up on your financial wellbeing. Scheduling a little time each week to focus on this important topic can help take a bite out of the additional stresses associated with back-to-school activities and holidays.

Here’s a list of helpful reminders to help you get started.

- Get organized for open enrollment. Nidec’s Open Enrollment period this year will be Nov. 4-Nov. 18, 2024.

- Confirm your mailing address is updated

- Review your current benefits to determine whether you might have different needs in 2025

- Consider now your benefits coverage and other benefits that Nidec offers that might help you manage any healthcare needs you and your family might have in 2025

- Identify your personal financial priorities.

- Review your spending during 2024

- Identify whether to modify your spending, saving and investments

- Decide now whether you’d like to pull back on holiday spending so you can find a way to contribute additional funds to your Nidec-sponsored 401(k) plan

- Make or update a will.

- If you don’t have a will, consider identifying what you need to get started

- If you have a will, review it, and make any necessary updates

- Make a list of end-of-year deadlines.

- Collect FSA-related expenses that you will submit for reimbursement by the end of the year

- Collect in one place any information that might make preparing for taxes next year easier

- Confirm your beneficiary designation information is updated.

Prepare for the year with preventive care

July 8, 2024 | submitted by The Nidec Human Resources Team

As you gear up for back-to-school with new school supplies make sure you are gearing up with physical exams and immunizations, too. Take advantage of the longer summer days and get those preventive care appointments on the calendar.

Through Nidec’s medical, dental and vision plans, preventive care is covered 100% as long as you are treated by an in-network provider.

- Medical: Preventive care, such as your annual checkup with your in-network provider as well as certain blood tests and cervical cancer screenings for women

- Dental: Preventive dental care, such as exams, cleanings, fluorides, x-rays, and sealants, with no applicable deductible

- Vision: Preventive eye care, such as frames (once every 12 months), contact lenses (once every 12 months in lieu of lenses or frames), and lenses (once every 12 months)

See the medical, dental and vision charts in your Nidec Benefits At-a-Glance to compare copays and in-network vs. out-of-network costs.

Mid-year reminder to use your FSA or HSA funds for eligible expenses such as, doctor visit copays, medical/dental deductibles, and more!

Skin Cancer Awareness Month

June 1, 2024 | submitted by The Nidec Human Resources Team

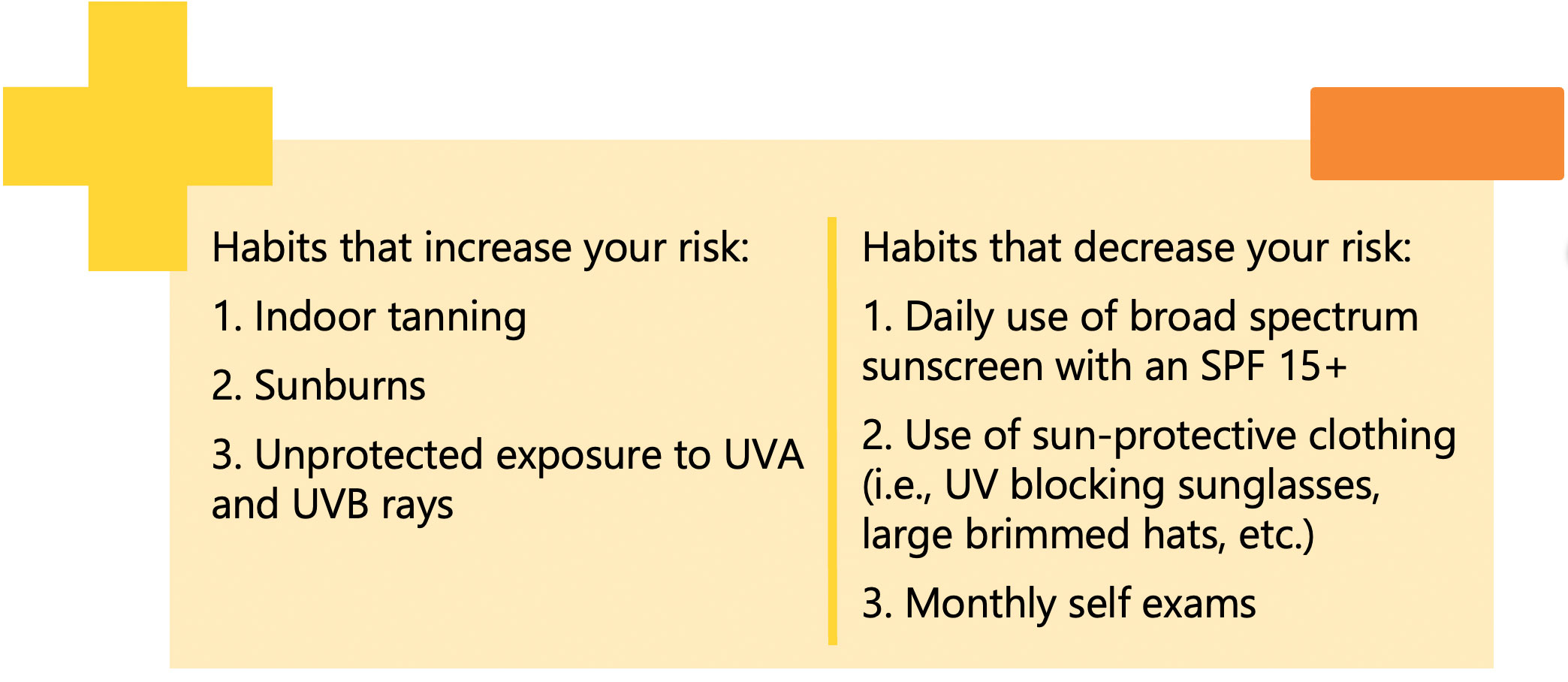

Did you know skin cancer is America’s most common form of cancer? Thankfully, it is also the most preventable. At Nidec, we want to ensure you and your loved ones stay safe during the summer months. Below are some tools to stay educated on preventing skin cancer.

Stay Safe in the Sun

Protect yourself from the rays before you head outdoors. This is especially important between 10 a.m. and 4 p.m. when the sun is most intense.

- Look for a sunscreen that blocks all UVA and UVB rays

- Use an SPF of at least 30

- Apply sunscreen on your entire body using one ounce, think enough to fill one shot glass

- Don’t miss putting it on ears, exposed scalp, and tops of feet!

- Reapply sunscreen every two hours, even on cloudy days

- Wear hats and cover up when able

- Clothing with a UPF label helps protect against the sun!

- Seek shade or bring your own shade by having an umbrella handy

Nidec Benefits – all for you

May 1, 2024 | submitted by The Nidec Human Resources Team

May is Mental Health and Global Employee Health & Fitness Month. At Nidec, we want you to feel supported in every aspect of life. That’s why we have well-being benefits and an EAP that were made with you and your loved ones in mind.

Well-being benefits

Prioritize your well-being this May and take advantage of Nidec’s well-being benefits.

- Check-in on your physical health and visit your primary care provider.

- Support your musculoskeletal needs or stay healthy and pain free with Hinge Health.

- Stay prepared with an FSA and avoid unforeseen out-of-pocket costs.

EAP

Life can bring up unforeseen challenges. During these moments, your EAP is here to help you and your loved ones. EAP is confidential and offered at no cost to you to help you manage:

- Stress management

- Emotional issues

- Depression, anxiety, and panic attacks

- Elder care resources

- Relationship and family problems

- And more!

Reaching out is the first step. Your EAP is available 24/7 at 314.845.8302 or 800.832.8302. You can also visit their website.

Don’t rely on luck – schedule important appointments today!

March 12, 2024 | submitted by The Nidec Human Resources Team

We’re three months into 2024 and it’s time to schedule your medical, dental and vision exams. Although these exams feel like a hassle, it is important to prioritize your health and prevent future illness now. Nidec offers robust medical, dental and vision plans, including preventative care at little or no cost to you. Take advantage of them to keep you and your family healthy in 2024.

Preventive care

Preventive care helps evaluate your current health status and can detect health problems early—before any signs or symptoms have appeared. Through regular preventive exams and screenings, you and your provider(s) can work together to manage your overall health. Below are ways our health plans support you and your family’s health.

- Medical exams – See an in-network provider and your office visit is 100% covered.

- Dental exams – See an in-network provider for a preventive exam that is 100% covered with no deductible.

- Vision exams – Visit an in-network provider once every 12 months to receive an eye exam for only a $10 dollar copay.

Flexible Spending Accounts (FSAs): Use it or lose it

February 23, 2024 | submitted by The Nidec Human Resources Team

Don’t leave money on the table with your FSA. Use your entire 2023 FSA balance by Mar. 15, 2024, to make the most of these tax-deferred funds.

- You have until Mar. 15, 2024, to spend health or dependent care funds that went unused last year.

- You have until Apr. 15, 2024, to submit claims for reimbursement.

- If you do neither, you will forfeit any unused funds.

- Other helpful information

- You can either use your FSA debit card or you can pay out-of-pocket and submit the reimbursement form. Follow instructions on the form.

- For a short video on how FSAs work and how you can get the most from your tax-advantaged account, click here.

- Remember to save receipts and be sure to track everything. Include the amount paid, payee’s name, and transaction date. Some purchases might require a letter of medical necessity or a prescription to be eligible.

- Go to Financial Security>>Flexible Spending Accounts (FSAs) on your benefits website for a list of eligible items for reimbursement.

- Consult with your tax advisor as this article is not tax advice.

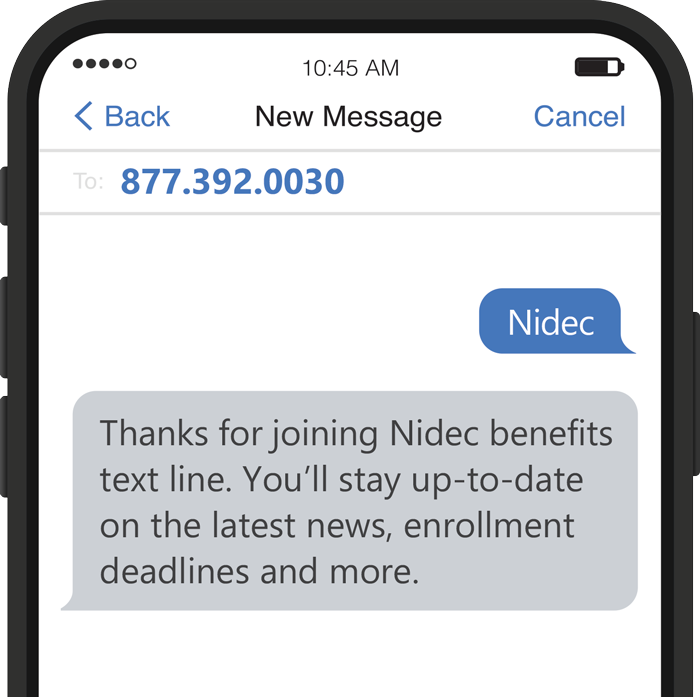

Benefits on the go

September 12, 2023 | submitted by The Nidec Human Resources Team

Are you enrolled to receive text message updates from our benefits team? Year-long updates are available straight to your smartphone, containing important messages and links regarding your benefits and open enrollment instructions. Text NIDEC to 877.392.0030 to sign up or scan the QR code to the right with your smartphone.

With our texting tool, you can:

- Make the most of your benefits with more access to detailed information

- Invite dependents to join so they are in the know

- Gain access to important reminders and deadlines, especially during open enrollment

- Receive direct links to helpful videos and websites regarding your benefits

Click this link to be directed to a webpage to sign up OR scan the QR code below and opt in for this tool now.

Wellness Goals: Stay in Your Groove with Wellness Challenges

August 3, 2023 | submitted by The Nidec Human Resources Team

As a reminder, we partner with Asset Health to provide our employees with ongoing wellness challenges to keep you motivated and strong all year long. You can access these challenges by visiting the Asset Health website via any device or browser. After you log into your Nidec account, simply click on “Challenges” at the top of the page and learn how to get started on your next challenge.

Unsure of where to begin? Tailor your challenges to your specific health goals for the remainder of the year. Here’s an idea: sign up for the mini challenges that are updated on a daily basis.

Your Benefits Profile for 2023: Is it Up to Date?

As life changes, your benefits needs may change as well

Beneficiary Updates

It is important to ensure your beneficiary information is up to date in your benefits profile. As a reminder, your beneficiary is the individual named in your life insurance policy, retirement plan, and/or health savings account that will receive these benefits in case of your death. It’s imperative that you evaluate your current beneficiary designation whenever new changes occur before submitting any updated benefits elections.

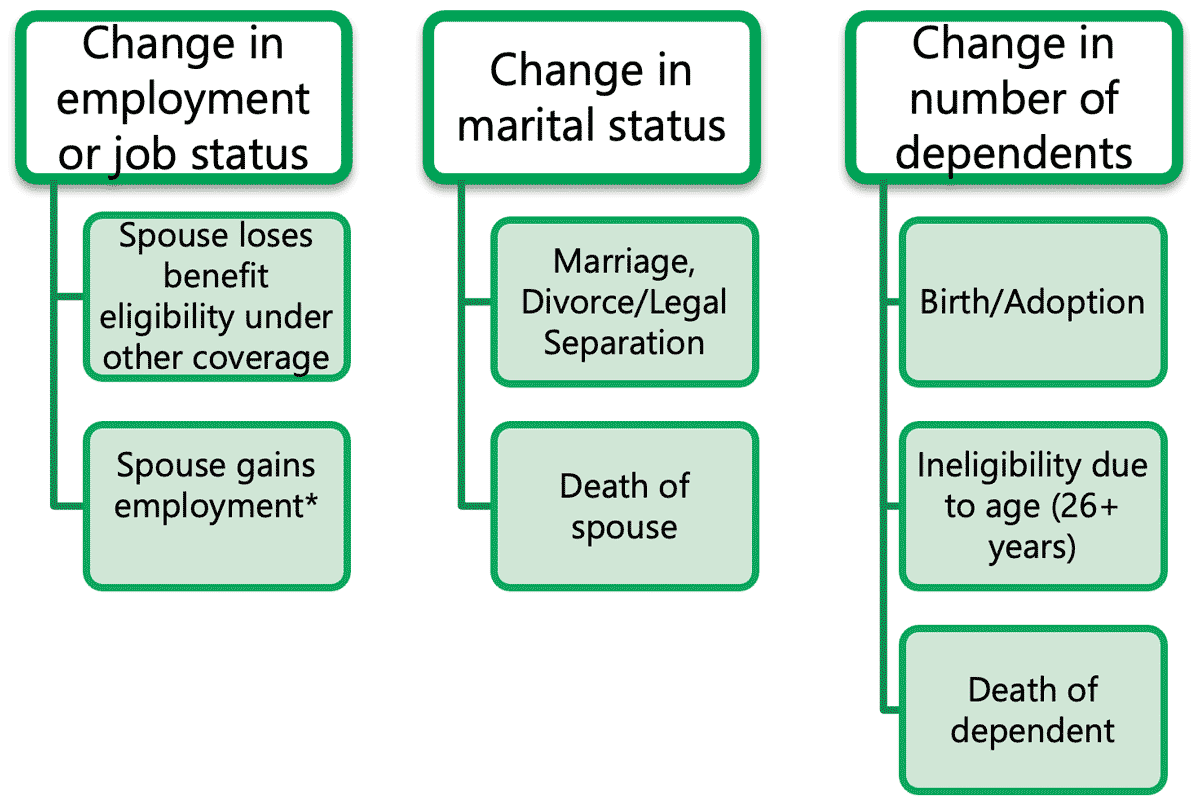

Qualifying Life Events

In some cases, big life events are called a qualifying life event. A qualifying life event allows you to update your benefits outside of Open Enrollment or new hire eligibility enrollment. Below is a list of some of the most common events:

- Change of marital status (e.g., marriage, divorce, legal separation, death of a spouse)

- Change in dependents (e.g., birth, adoption, ineligibility due to age [children over 26], death of dependent

- Change in job status (e.g., your spouse loses benefit eligibility status under other coverage)

Is There a Deadline to Enroll in or Change my Benefits?

After a qualifying life event occurs, contact your local Human Resources Partner to open up your benefits enrollment to make the necessary changes. Typically, you will have 30 days after the event (e.g., birth of child, marriage, your spouse loses benefits coverage through their employer, etc.) to file an application to change your benefits.

Remember that when you make a change to your benefits due to a qualifying life event, your changes must be consistent with the event itself. For example, if a dependent loses eligibility due to age (over 26 years old), you cannot use that event to change medical plan selections for yourself.

Hinge Health: Back and Joint Management at Every Turn

Whether you are managing your back and joint pain, recovering from an injury, preparing for an upcoming surgery, or simply looking for more ways to stay healthy, Hinge Health gives you the tools to overcome any obstacle. Better yet, their services are free for you and any dependents currently enrolled in a BCBSA Health Plan. You can even receive wearable sensors from Hinge Health directly that can give live feedback on your form straight to the mobile app!

Comfort for Comfort

Hinge Health is optimized so that you can begin this journey from the comfort of your own home. Hinge Health will help you gather a personalized team of therapists and health coaches. If you have recently undergone a surgery, you can also use Hinge Health to schedule unlimited physical therapy sessions, and even receive a second opinion on your recommended surgery and treatment plan.

Planning for the Future

Sign up for the free app to receive tailored exercises directly to your phone, based off your job and lifestyle.

Don’t hesitate to reach out!

For Hinge Health questions, call 855.902.2777 or send an email to hello@hingehealth.com. After enrollment, download the Hinge Health app in your Google Play/App store.

Skin Cancer Awareness Month

June 21, 2023 | submitted by The Nidec Human Resources Team

Skin cancer is America’s most common form of cancer, with more than 5 million cases reported each year. Thankfully, it is also the most preventable. Below are some tools to stay educated on preventing skin cancer.

Skin cancer is America’s most common form of cancer, with more than 5 million cases reported each year. Thankfully, it is also the most preventable. Below are some tools to stay educated on preventing skin cancer.

Get Involved

Still Curious About Your Individual Risk?

Click here for an online quiz to determine your skin type and how to protect it from harmful exposure.

Back-to-School Savings on Preventive Care

June 21, 2023 | submitted by The Nidec Human Resources Team

Even though schools are out for the summer, back-to-school preparation will be here before you know it. Consider making those back-to-school doctor appointments, now. This year, you might see some cost savings when taking these important steps on preventative care for you and your family members. Did you know that back-to-school required physical exams and immunizations are covered under your health plan at 100%? As long as you are treated by an in-network provider, Nidec’s health plans cover preventive care—even certain preventive medications—at no cost to you.

This also includes:

- Preventive dental care, such as exams, cleanings, fluorides, x-rays, and sealants, with no applicable deductible

- Preventive eye care, such as frames (once every 12 months), contact lenses (once every 12 months in lieu of lenses or frames), and lenses (once every 12 months). See chart in your Benefits Guide on page 16 to compare copays and in-network vs. out-of-network costs.

Double Up on Savings with an FSA/HSA

When you enroll in a Flexible Spending Account (FSA) or a Health Savings Account (HSA), you are provided with a list of items that fall under the umbrella of eligible expenses. You may use your FSA and HSA funds to purchase these eligible expenses using tax-free dollars.

When you enroll in a Flexible Spending Account (FSA) or a Health Savings Account (HSA), you are provided with a list of items that fall under the umbrella of eligible expenses. You may use your FSA and HSA funds to purchase these eligible expenses using tax-free dollars.

Challenge Yourself and be Rewarded

May 1, 2023 | submitted by The Nidec Human Resources Team

Our Wellness Challenge partner, Asset Health, invites you to take part in Nidec’s ongoing Wellness Challenges by accessing them online or through your mobile device on their website. Simply click on “Challenges” at the top of the page and you are on your way to saving money!

“Fill Your Cup” with our Hydration Challenge

The Hydration Challenge is designed to help you improve your health by increasing daily water intake. In the Hydration Challenge, participants can earn one point for every 8 ounces of water they drink each day, up to a maximum of eight points per day. This challenge runs from June 12 through July 9.

Get Fit and Earn Points (no gym equipment required)

The goal for the challenge is to record a certain number of steps per week. Participants will have an avatar that fills based on the number of steps they record. The avatar can be customized by the participant.

Learn More

Tired of missing out? Opt in for text alerts now and get important Benefits alerts and links wherever you go! Text NIDEC to 877.392.0030 to get started.

Use These Tips to Save Money

April 1, 2023 | submitted by The Nidec Human Resources Team

Know When to Stay and When to Go

- If you are not experiencing an emergency, and are unsure where to go for care, call your doctor to discuss your medical needs and find appropriate care

- Skip the hospital bill and schedule an appointment at your local urgent care

- If this is a chronic issue, schedule a visit with your Primary Care Physician and save on spending money on multiple urgent care visits

- If you are experiencing a life-threatening medical emergency, go to your local emergency room or call 911

- Chest pain, heart attack, head trauma, overdose, severe allergic reaction, shortness of breath, blurry or loss of vision can all be classified as emergencies

Chew Away at Extra Costs this National Nutrition Month

“An Apple a Day…”

- Healthy habits can lower your overall healthcare costs

- Incorporate a rainbow of food colors every day to ensure you’re consuming important vitamins and nutrients

- Exercise at least 30 minutes/day

Rx Review

- Review your prescriptions every 6 months to make sure you’re getting the most bang for your buck

- Prescription costs can vary greatly; generic medications can have the exact same active ingredients as brand-name and cost you less

- For more information on how to put money back in your wallet, watch this short presentation

Learn More

Click here to better understand your options for medical care.

When Life Changes So May Your Benefits

April 1, 2023 | submitted by The Nidec Human Resources Team

When a big event happens in your family’s life, such as the birth of a child, it is natural to wonder about the next steps to take.

At Nidec, we want you to put your and your family’s needs first. What’s the best way to start? Prepare and protect your loved ones with optimal benefits coverage to keep you healthy and safe during life’s changes – big or small. The chart below shows common qualifying life events:

How Long Do I Have to Enroll After an Event?

*Important note: Nidec’s working spouse provision applies. This means that if your spouse is working for an employer who offers a health plan, the plan requires them to enroll in that employer-sponsored coverage.

After a qualifying life event occurs, contact your local Human Resources Representative to open up your benefits enrollment to make the necessary changes. Typically, you will have 30 days after the event (i.e. birth of child, marriage, spousal other coverage loss) to file an application to change your benefits.

Don’t Forget to Change Your Beneficiary(ies)

During a big life change, it is just as important to ensure that your beneficiary is up to date! A beneficiary is the individual named in your life insurance policy, retirement plan, and/or health savings account that will receive these benefits in the case of a death. After a qualifying life event has occurred, it’s imperative that you evaluate your current beneficiary and make any necessary changes to ensure no delay in payments.

Important Note

When you make a change to your benefits due to a qualifying life event, your changes must reflect only that event itself. For example, if you need to add a new child as a dependent after birth, you cannot use that event to change coverage for yourself as well.

New Year, New Focus — National Nutrition Month

March 1, 2023 | submitted by The Nidec Human Resources Team

What better time to refocus ourselves on our current wellness habits than during National Nutrition Month? Nutrition and physical activity go hand-in-hand to offer you a more fruitful future.

Pay Attention to Your Plate

Make every bite count by knowing what and how much to put on your plate. Try to keep these portions for each meal:

Make every bite count by knowing what and how much to put on your plate. Try to keep these portions for each meal:

- Half of your plate should be made of fruits and veggies; try focusing on the whole fruits

- Veggies should vary from meal-to-meal

- Make ½ of your grains whole grain

- Vary your protein consumption, i.e. eggs, beef, fish

Substitute the Sugars

Let’s play a game of This or That! The chart below will give you a list of common sugary drinks and treats, along with two healthier choices next to them. The next time you reach for these treats, try out one of the healthier options instead!

| This | That | |

|---|---|---|

| Soda | Zevia Soda | Aha! Sparkling Water |

| Cookies/Candy | Frozen chocolate covered bananas | Peanut butter protein balls |

| Flavored latte | Matcha Latte | Chai Tea |

| Ice Cream | Vanilla Greek Yogurt w/ berries/choc. chips | Sherbet |

| Cake w/ buttercream frosting | No-bake cheesecake | Banana cupcakes w/ cream cheese frosting |

All For Health Wellness Program

From now until October 31, 2023, participate in the All For Health Wellness Program to keep you healthy and save you money. Points earned during the 2023 plan year will help you earn 2024 medical premium savings. Visit our Wellness Program page and click on the link for Activities for info on how to save!

Be Happy, Be Healthy, Be Well – Employee Assistance Program

March 1, 2023 | submitted by The Nidec Human Resources Team

At Nidec, we want you to feel your best each day you come to work AND leave the office. Sometimes, that requires more help from those around you. When this is the case, take part in our Employee Assistance Program.

What Does the Employee Assistance Program (EAP) Offer?

The EAP is a confidential service designed to help employees and families with personal or work/life balance issues. Nidec offers the EAP to help you toward an early resolution of your personal concerns. This includes access to tens of thousands of clinicians throughout the country without a predetermined limit on the number of in-person sessions.

The following are issues that the EAP can address and help you manage:

- Stress management

- Emotional issues

- Depression, anxiety, and panic attacks

- Elder care resources

- Relationship and family problems

- Chemical dependency

- Eating disorders

- Domestic violence

- …and more

For a better understanding of the EAP’s services, watch this short video.

Is the EAP Confidential?

The EAP cannot disclose any information without your written consent. The only exceptions are those required by law.

How Can I Get Started?

Reach out to the EAP directly and start the conversation now. The EAP is available to you 24 hours a day/7 days a week at 314-845-8302 or 800-832-8302. You can also visit their website.

Is There a Cost to Use the EAP Services?

There is no charge for any services provided within the EAP. If you are referred outside of the EAP services for additional help, you will be responsible for those services. As always, it is best to reach out to your health insurance provider before using these referred services to confirm if a portion of the costs will be covered by your plan.

Get Your Free Flu Shot!

December 9, 2022 | submitted by The Nidec Human Resources Team

Flu shots are a covered benefit

Annual flu shots are covered 100% under your health plan and can be administered in seconds. It takes about two weeks to become effective.

It’s never too late to protect yourself

It’s never too late to protect yourself

The flu virus typically peaks between December and February and can keep you down for days. Stop by your participating doctor’s office or pharmacy today for your covered flu shot.

- Talk to your doctor or pharmacist first if you are now ill or have had severe, adverse reactions to past flu shots.

- Before you seek non-emergency healthcare, it is a good idea to call the provider to make sure your health plan is accepted. Always choose an in-network provider to pay the lowest out-of-pocket cost for your healthcare.

Finding in-network providers is easy

- Login to your myBlueCross account on AlabamaBlue.com or the Alabama Blue mobile app and click “Find a Doctor.”

- Call the member customer service number on the back of your Blue Cross ID card.

Did You Know?

Each year in the United States …

- 1 out of 5 get the flu

- 200K are hospitalized with the flu

- 60K die from the flu

(Source: Centers for Disease Control and Prevention)

Registered Dietitians Available to Support Employees with Certain Health Conditions

August 20, 2022 | submitted by The Nidec Human Resources Team

Did you know? In-network dietitian services are covered for employees and family members who have certain medical conditions and who participate in BlueCross BlueShield of Alabama plans. Working with a registered dietitian can help control — and even prevent — health challenges such as obesity and diabetes.

Did you know? In-network dietitian services are covered for employees and family members who have certain medical conditions and who participate in BlueCross BlueShield of Alabama plans. Working with a registered dietitian can help control — and even prevent — health challenges such as obesity and diabetes.

Empowered to Develop Better Eating Habits

With these dietician benefits, Nidec employees and their families have an opportunity to control and even prevent health problems. Having benefits for Medical Nutrition Therapy (MNT) enables you to receive assistance with:

- Creating diet plans

- Diabetes education

- Support in managing chronic and acute conditions.

Get All the Details

In-network services are covered on your benefit plan as follows:

- PPO Plan – Covered at 100% of the allowance, subject to a $30 per visit co-pay.

- High Deductible Health Plan – Covered at 80% of the allowance, subject to the calendar year deductible.

For a complete list of covered conditions, please refer to the plan document found under Resources > Document Library on this website.

Surprise! You Can Use Your FSA Card to Pay for That

August 20, 2022 | submitted by The Nidec Human Resources Team

Sure, you can use your healthcare flexible spending account (FSA) to pay for your daughter’s visit to the ER when she makes a bad slide into home plate and your son’s allergy appointments to survive ragweed season… but did you know you can also use your FSA for other items too? This is a good time to check your accounts to be sure your spending matches your saving for the year.

Your Healthcare FSA Might Pay For…

You might be surprised to learn that your healthcare FSA may be used to pay for prescription sunglasses, sunscreen, lip balm with SPF and (when all else fails) aloe to sooth a sunburn. You can’t charge your camping trip, but you can stock up on a first aid kit, a jumbo box of adhesive bandages (in case you come back from the hike with blisters), and even a cold pack for your sore muscles.

You might be surprised to learn that your healthcare FSA may be used to pay for prescription sunglasses, sunscreen, lip balm with SPF and (when all else fails) aloe to sooth a sunburn. You can’t charge your camping trip, but you can stock up on a first aid kit, a jumbo box of adhesive bandages (in case you come back from the hike with blisters), and even a cold pack for your sore muscles.

In addition, families sending a student off to college this fall can use their FSA card for all of the basics: new glasses, many skincare products, cushioned insoles for the student’s hikes across campus, and even over-the-counter pain relief medications for when they’ve been up “studying” all night.

Use It — Don’t Lose It

You will need to use most of your FSA dollars within this calendar year or you’ll lose them. Wondering how much is in your FSA account? Visit HealthEquity to check your balance today.